Carol and Sam Foyle own Campus Fashions. From its inception Campus Fashions has sold merchandise on either

Question:

Carol and Sam Foyle own Campus Fashions. From its inception Campus Fashions has sold merchandise on either a cash or credit basis, but no credit cards have been accepted. During the past several months, the Foyles have begun to question their sales policies. First, they have lost some sales because of refusing to accept credit cards. Second, representatives of two metropolitan banks have been persuasive in almost convincing them to accept their national credit cards. One bank, City National Bank, has stated that its credit card fee is 4%.

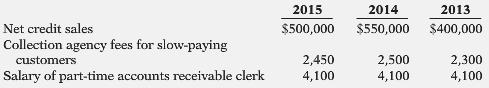

The Foyles decide that they should determine the cost of carrying their own credit sales. From the accounting records of the past 3 years, they accumulate the following data.

Credit and collection expenses as a percentage of net credit sales are uncollectible accounts 1.6%, billing and mailing costs 0.5%, and credit investigation fee on new customers 0.15%.

Carol and Sam also determine that the average accounts receivable balance outstanding during the year is 5% of net credit sales. The Foyles estimate that they could earn an average of 8% annually on cash invested in other business opportunities.

Instructions

With the class divided into groups, answer the following.

(a) Prepare a table showing, for each year, total credit and collection expenses in dollars and as a percentage of net credit sales.

(b) Determine the net credit and collection expense in dollars and as a percentage of sales after considering the revenue not earned from other investment opportunities.

(c) Discuss both the financial and nonfinancial factors that are relevant to the decision.

Step by Step Answer:

Accounting Principles

ISBN: 9781118566671

11th Edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso