Question: Change from Equity to Fair Value Gamble Corp. was a 30% owner of Sabrina Company, holding 210,000 shares of Sabrina?s common stock on December 31,

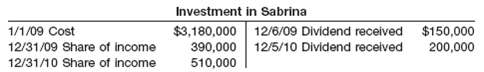

Change from Equity to Fair Value Gamble Corp. was a 30% owner of Sabrina Company, holding 210,000 shares of Sabrina?s common stock on December 31, 2010. The investment account had the following entries. On January 2, 2011, Gamble sold 126,000 shares of Sabrina for $3,440,000, thereby losing its significant influence. During the year 2011 Sabrina experienced the following results of operations and paid the following dividends to Gamble.?

? ? ? ? ? ? ? ? ? Sabrina ? ? ? ? ? ? ? ? ? ? ? ? ? ?Dividends Paid

? ? ? ? ? ? ? Income (Loss)? ? ? ? ? ? ? ? ? ? ? ? ?to Gamble

2011 ? ? ? ?$350,000 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?$50,400

At December 31, 2011, the fair value of Sabrina shares held by Gamble is $1,570,000. This is the first reporting date since the January 2 sale.

(a) What effect does the January 2, 2011, transaction have upon Gamble?s accounting treatment for its investment in Sabrina?

(b) Compute the carrying amount in Sabrina as of December 31, 2011.

(c) Prepare the adjusting entry on December 31, 2011, applying the fair value method to gamble?s long-term investment in Sabrina Company securities.

Investment in Sabrina $3,180,000 12/6/09 Dividend received $150,000 1/1/09 Cost 200,000 12/31/10 Share of income 510,000

Step by Step Solution

3.51 Rating (171 Votes )

There are 3 Steps involved in it

a Prior to January 2 2011 Gamble Corp carried the investment in Sabrina Company under the equity met... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-E-A (59).docx

120 KBs Word File