Question: Charles and Cathy are employed by different companies. They earn the same amount of income and share a similar lifestyle. However, each receives a different

Charles and Cathy are employed by different companies. They earn the same amount of income and share a similar lifestyle. However, each receives a different type of remuneration.

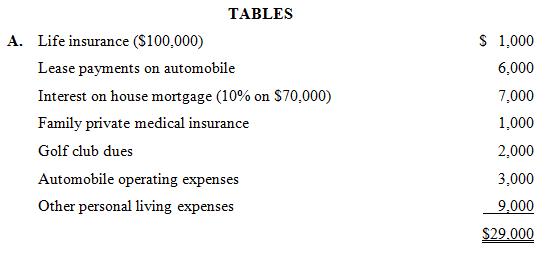

Charles earns a total of $50,000, which is paid in the form of a monthly salary. His annual personal expenses (excluding income tax) are shown in table A.

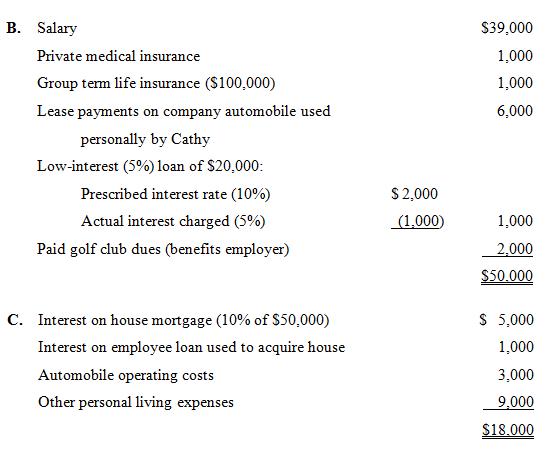

Cathy also earns $50,000 annually. Her remuneration is as shown in table B. Her personal expenses (excluding income tax) are shown in table C.

Both Charles and Cathy pay income tax at a rate of 40%. Both invest any savings in an effort to build up a substantial investment portfolio.

Required:

1. For the current year, compare Cathy’s after-tax cash flow with that of Charles, and determine the amount each has available to add to an investment portfolio.

2. What amount of salary would Charles have to receive in order to have the same amount of cash available as Cathy for his investment portfolio?

TABLES Life insurance (S100,000) Lease payments on automobile Interest on house mortgage (10% on $70,000) Family private medical insurance Golf club dues Automobile operating expenses Other personal living expenses A. S 1,000 6,000 7,000 1.000 2,000 3,000 9.000 $29.000 S39,000 1,000 1.000 6,000 B. Salary Private medical insurance Group term life insurance ($100,000) Lease payments on company automobile used personally by Cathy Low-interest (5%) loan of $20,000; S 2,000 Prescribed interest rate (10%) Actual interest charged (5%) 1,000 2,000 $50.000 (1000) Paid golf club dues (benefits employer) Interest on house mortgage (10% of $50,000) Interest on employee loan used to acquire house Automobile operating costs Other personal living expenses S 5,000 1,000 3,000 9.000 $18.000 C.

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

1 Both Charles and Cathy earn remuneration of 50000 from their employers Both have identical living ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

691-L-B-L-I-T-E (623).docx

120 KBs Word File