Question: Choosing cost drivers, activity-based costing, activity-based management. Annie Warbucks runs a dance studio with childcare and adult fitness classes. Annies budget for the upcoming year

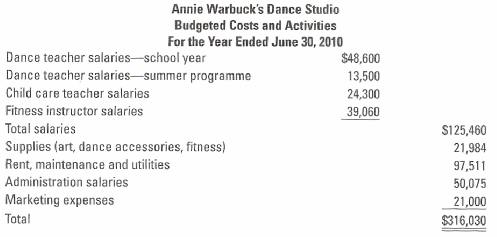

Choosing cost drivers, activity-based costing, activity-based management. Annie Warbucks runs a dance studio with childcare and adult fitness classes. Annie’s budget for the upcoming year is as follows:

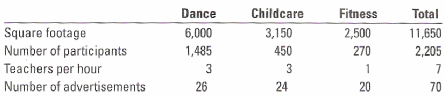

Other information:

Dance classes 3 per hour

Hours of operation

(Dance, Childcare and Fitness)—school year (36 weeks) 2 p.m. to 8 p.m. M—F

Hours of operation

(Dance, Childcare and Fitness)—summer programme (10 weeks) 9 am. to noon; 1 p.m. to 4p.m. M—F

Other information:

1. Determine which costs are direct costs and which costs are indirect costs of different programs.

2. Choose a cost driver for the indirect costs and calculate the cost per unit of the cost driver. Explain briefly your choice of cost driver.

3. Calculate the budgeted costs of each program.

4. How can Annie use this information for pricing? What other factors should she consider?

Annie Warbuck's Dance Studio Budgeted Costs and Activities For the Year Ended June 30, 2010 $48,600 Dance teacher salaries-school year Dance teacher salaries-summer programme 13,500 Child care teacher salaries 24,300 Fitness instructor salaries 39,060 Total salaries $125,460 Supplies (art, dance accessories, fitness) 21,984 Rent, maintenance and utilities 97,511 Administration salaries 50,075 Marketing expenses 21,000 $316,030 Total

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Choosing cost drivers activitybased costing activitybased management 1 Direct costs Dance teacher salaries Child care teacher salaries Fitness instruc... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-P-A (183).docx

120 KBs Word File