Question: Chuck Wagon Grills, Inc., makes a single producta handmade specialty barbecue grill that it sells for $210. Data for last years operations follow: Required: 1.

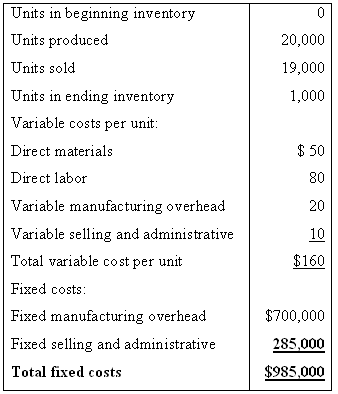

Chuck Wagon Grills, Inc., makes a single product—a handmade specialty barbecue grill that it sells for $210. Data for last year’s operations follow:

Required:

1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill.

2. Assume that the company uses variable costing. Prepare a contribution format income statement for the year.

3. What is the company’s break-even point in terms of the number of barbecue grills sold?

Units in beginning inventory Units produced 20,000 Units sold 19,000 Units in ending inventory 1,000 Variable costs per unit: $ 50 Direct materials Direct labor 80 Variable manufacturing overhead 20 Variable selling and administrative 10 Total variable cost per unit $160 Fixed costs: $700,000 Fixed manufacturing overhead 285,000 Fixed selling and administrative Total fixed costs $985,000

Step by Step Solution

3.41 Rating (173 Votes )

There are 3 Steps involved in it

1 Under variable costing only the variable manufacturing costs are included in product costs Direc... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-V-C (18).docx

120 KBs Word File