Question: Cleveland Computer Accessory Company (CCAC) distributes keyboard trays to computer stores. The keyboard trays can be attached to the underside of a desk, effectively turning

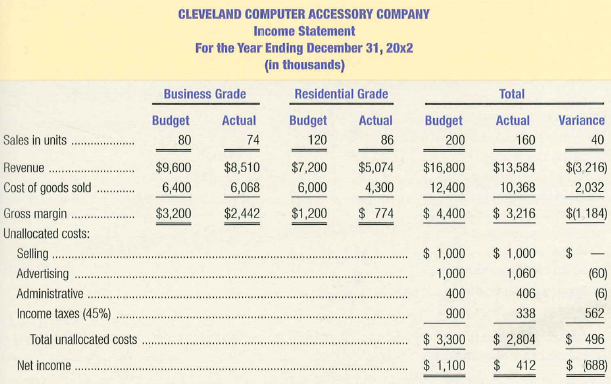

Cleveland Computer Accessory Company (CCAC) distributes keyboard trays to computer stores. The keyboard trays can be attached to the underside of a desk, effectively turning it into a computer table. The keyboard trays are purchased from a manufacturer that attaches CCAC’s private label to the trays. The wholesale selling prices to the computer stores are $120 for the business-grade keyboard tray and $60 for the residential-grade product. The 20x2 budget and actual results are as follows. The budget was adopted in late 20x 1 and was based on CCAC’s estimated share of the market for the Iwo types of keyboard trays.

During the first quarter of 20x 2, management estimated that the total market for these products actually would be 10 percent below the original estimates. In an attempt to prevent unit sales from declining as much as industry projections, management implemented a marketing program. Included in the program were dealer discounts and increased direct advertising. The business grade line was emphasized in this program.

Required:

1. Compute the sales-price and sales-volume variances for cacti product line. Indicate whether each variance is favorable or unfavorable.

2. Discuss the apparent effect of CCAC’s special marketing program (i.e., dealer discounts and additional advertising) on the 20x 2 operating results.

CLEVELAND COMPUTER ACCESSORY COMPANY Income Statement For the Year Ending December 31, 20x2 (in thousands) Business Grade Residential Grade Total Budget Actual Budget Actual Budget Actual Variance Sales in units 80 74 120 86 200 160 40 $8,510 $7,200 $5,074 $16,800 $13,584 $(3.216) Revenue $9,600 2,032 Cost of goods sold 6,400 6,068 6,000 4,300 12,400 10,368 $ 4,400 $ 3,216 $ 774 $3,200 $2,442 $1,200 $(1.184) Gross margin . Unallocated costs: $ 1,000 Selling . $ 1,000 (60) 1,060 Advertising 1,000 Administrative 400 406 (6) Income taxes (45%) 900 338 562 $ 3,300 $ 2,804 $ 496 Total unallocated costs $ 1,100 $ 412 $ 688) Net income

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

1 Salesprice variances and salesvolume variances SalesPrice Variance Actual Sales Price Budgeted Sales Price Price Difference Actual Sales Volume Sale... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

238-B-M-A-F-B (354).docx

120 KBs Word File