Colorado Coal Company has estimated the costs of debt and equity capital (with bankruptcy and agency costs)

Question:

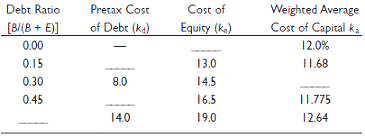

Colorado Coal Company has estimated the costs of debt and equity capital (with bankruptcy and agency costs) for various proportions of debt in its capital structure.

The company’s income tax rate is 40 percent.

a. Fill in the missing entries in the table.

b. Determine the capital structure (i.e., debt ratio) that minimizes the firm’s weighted average cost of capital.

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Contemporary Financial Management

ISBN: 9780324289114

10th Edition

Authors: James R Mcguigan, R Charles Moyer, William J Kretlow

Question Posted: