Question: Combining information from the S&P reports and some estimated data for 2013, the following calendar-year data, on a per-share basis, are provided: a. Calculate the

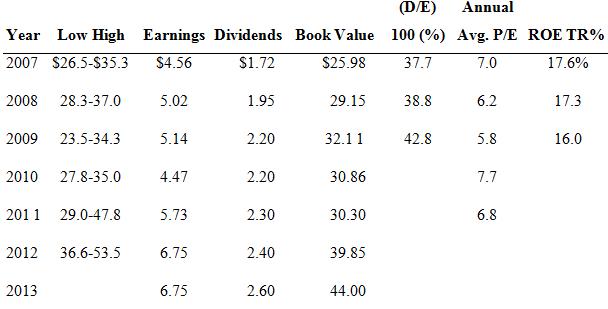

Combining information from the S&P reports and some estimated data for 2013, the following calendar-year data, on a per-share basis, are provided:

a. Calculate the D/E, ROE, and TR for 2010, 2011, and 2012. (Use the average of the low and high prices to calculate TRs.)

b. Show that from 2007 through 2012 the per annum growth rate in dividends was percent and for earnings was 8.2 percent (both rounded).

c. Using the current price of $47, with estimated earnings for 2013 of $6.75, show that E would be evaluated as 6.96.

d. On the basis of the annual average P/E ratios shown above and your estimate in c), an expected P/E of 7. If an investor expected the earnings of PGJ for 2013 to be $7. show that the intrinsic value would be $52.50.

c. What factors are important in explaining the difference in the P/E ratios of Coca and PGJ?

f. From your calculation of the growth rate of dividends in b), assume that the annual rate 7 percent. If the required rate of return for the stock is 12 percent and the e dividend payout ratio is 0.4, show that P/E = 8.

g. If the dividend payout ratio is 0.4 and the return on equity is 15 percent, show g = 0.09.

h. Using k = 0.14 and g = 0.09, with expected 2013 dividends of $2.60, show that the intrinsic value is $52.

(D/E) Annual Year Low High Earnings Dividends Book Value 100(%) Avg. P/E ROETR% 2007 S26.5-S35.3 S4.56 2008 28.3-37.0 5.02 2009 23.5-34.3 2010 27.8-35.0 4.47 2011 29.0-47.85 2012 36.6-53.5 2013 S1.72 1.95 2.20 2.20 2.30 2.40 2.60 7.0 6.2 5.8 7.7 6.8 $25.98 37.7 17.6% 17.3 16.0 29.15 38.8 32.11 30.86 30.30 39.85 44.00 5.14 42.8 5.13 6.75 6.75

Step by Step Solution

3.44 Rating (173 Votes )

There are 3 Steps involved in it

a DE 22447492 23573401 24675356 ROE 4473086145 5733030189 6753985169 TR TR2010 31428922289 0163 163 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

650-B-A-I (7518).docx

120 KBs Word File