Question: Comparative balance sheets for Eddie Murphy Company are presented below. Additional information:1. Net income for 2010 was $125,000.2. Cash dividends of $60,000 were declared and

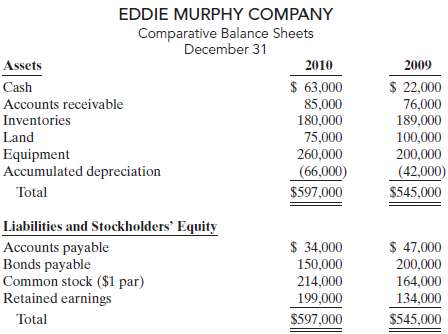

Comparative balance sheets for Eddie Murphy Company are presented below.

Additional information:1. Net income for 2010 was $125,000.2. Cash dividends of $60,000 were declared and paid.3. Bonds payable amounting to $50,000 were redeemed for cash $50,000.4. Common stock was issued for $50,000 cash.5. Depreciation expense was $24,000.6. Sales for the year were $978,000.InstructionsPrepare a worksheet for a statement of cash flows for 2010 using the indirect method. Enter the reconciling items directly on the worksheet, using letters to cross-reference eachentry.

EDDIE MURPHY COMPANY Comparative Balance Sheets December 31 2010 Assets 2009 $ 63,000 $ 22,000 Cash Accounts receivable 85,000 180,000 76,000 189,000 Inventories 75,000 Land 100,000 200,000 Equipment Accumulated depreciation 260,000 (66,000) (42,000) $597,000 $545,000 Total Liabilities and Stockholders' Equity $ 34,000 $ 47,000 Accounts payable Bonds payable Common stock ($1 par) Retained earnings 150,000 200,000 214,000 164,000 199,000 134,000 Total $597,000 $545,000

Step by Step Solution

3.31 Rating (163 Votes )

There are 3 Steps involved in it

EDDIE MURPHY COMPANY Worksheet Statement of Cash Flows For the Year Ended December 31 2010 Balance 1... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-A-B-S-C-F (188).docx

120 KBs Word File