Question: Comparative consolidated financial statements for Pil Corporation and its 80 percent-owned subsidiary at and for the years ended December 31 are summarized as follows: REQUIRED:

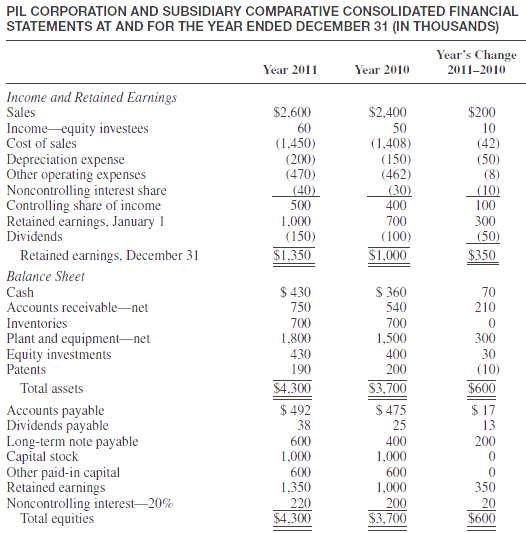

Comparative consolidated financial statements for Pil Corporation and its 80 percent-owned subsidiary at and for the years ended December 31 are summarized as follows:

REQUIRED: Prepare a consolidated statement of cash flows for Pil Corporation and Subsidiary for the year ended December 31, 2011. Assume that all changes in plant assets are due to asset acquisitions and depreciation. Income and dividends from 20 percent- to 50 percent-owned investees for 2011 were $60,000 and $30,000, respectively. Pil's only subsidiary reported $200,000 net income for 2011 and declared $100,000 in dividends during the year. Patent amortization for 2011 is$10,000.

PIL CORPORATION AND SUBSIDIARY COMPARATIVE CONSOLIDATED FINANCIAL STATEMENTS AT AND FOR THE YEAR ENDED DECEMBER 31 (IN THOUSANDS) Year's Change 2011-2010 Year 2011 Year 2010 Income and Retained Earnings Sales $200 $2.600 $2.400 Income-equity investees Cost of sales Depreciation expense Other operating expenses Noncontrolling interest share Controlling share of income Retained earnings, January 1 Dividends 60 (1,450) (200) (470) 50 10 (42) (1,408) (150) (462) (50) (8) (40) 500 (30) 400 (10) 100 1,000 700 300 (50) (150) (100) $1.350 S1,000 $350 Retained earnings. December 31 Balance Sheet $ 430 S 360 540 Cash Accounts receivable-net 70 210 750 Inventories Plant and equipment-net Equity investments Patents 700 1,800 430 190 700 1,500 400 200 300 30 (10) $4.300 S3,700 $600 Total assets $ 492 38 $ 475 25 $ 17 Accounts payable Dividends payable Long-term note payable Capital stock Other paid-in capital Retained earnings Noncontrolling interest-20% Total equities 13 600 1,000 400 200 1,000 600 1,350 600 1,000 350 220 200 20 $3,700 $600 $4.300

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Indirect Method Pil Corporation and Subsidiary Consolidated Statement of Cash Flows for the year ended December 31 2011 Cash Flows from Operating Activities Controlling share of NI 500000 Adjustments ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-C (37).docx

120 KBs Word File