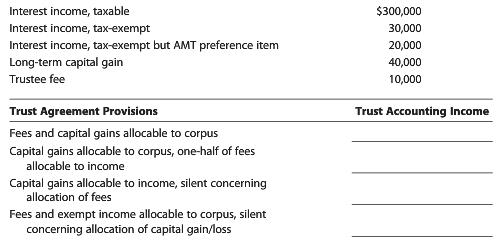

Question: Complete the chart below, indicating the Calvet Trusts entity accounting income for each of the alternatives. For this purpose, use the following information. Interest income,

Complete the chart below, indicating the Calvet Trust’s entity accounting income for each of the alternatives. For this purpose, use the following information.

Interest income, taxable Interest income, tax-exempt Interest income, tax-exempt but AMT preference item Long-term capital gain Trustee fee 300,000 30,000 20,000 40,000 10,000 Trust Agreement Provisions Fees and capital gains allocable to corpus Capital gains allocable to corpus, one-half of fees Trust Accounting Income allocable to income Capital gains allocable to income, silent concerning allocation of fees Fees and exempt income allocable to corpus, silent concerning allocation of capital gain/loss

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Trust Agreement Provisions Fees and capital gains allocable to corpus 350000 3... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

527-L-B-L-I-T-E (507).docx

120 KBs Word File