Question: Completed-Contract Method) Monat Construction Company, Inc., entered into a firm fixed price contract with Hyatt Clinic on July 1, 2010, to construct a four-story office

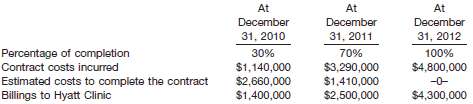

Completed-Contract Method) Monat Construction Company, Inc., entered into a firm fixed price contract with Hyatt Clinic on July 1, 2010, to construct a four-story office building. At that time, Monat estimated that it would take between 2 and 3 years to complete the project. The total contract price for construction of the building is $4,400,000. Monat appropriately accounts for this contract under the completed-contract method in its financial statements and for income tax reporting. The building was deemed substantially completed on December 31, 2012. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to the Hyatt Clinic under the contract are shown below.

Instructions

(a) Prepare schedules to compute the amount to be shown as "Cost of uncompleted contract in excess of related billings" or "Billings on uncompleted contract in excess of related costs" at December 31, 2010, 2011, and 2012. Ignore income taxes. Show supporting computations in good form

(b) Prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2010, 2011, and 2012. Ignore income taxes. Show supporting computations in good form

At At December 31, 2010 At December 31, 2011 December 31, 2012 Percentage of completion Contract costs incurred Estimated costs to complete the contract Billings to Hyatt Clinic 100% 30% 70% $4,800,000 $1,140,000 $3,290,000 $2,660,000 $1,410,000 $2,500,000 -0- $1,400,000 $4,300,000

Step by Step Solution

3.38 Rating (170 Votes )

There are 3 Steps involved in it

a MONAT CONSTRUCTION COMPANY INC Computation of Billings on Uncompleted Contract In Excess of Related Costs December 31 2010 Partial billings on contr... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-R-R (90).docx

120 KBs Word File