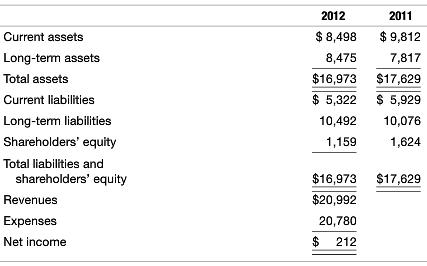

Question: Condensed balance sheets for 2011 and 2012 and the 2012 income statement for Goodyear, the worlds largest tire company, are as follows (dollars in millions).

Condensed balance sheets for 2011 and 2012 and the 2012 income statement for Goodyear, the world’s largest tire company, are as follows (dollars in millions).

a. Early in 2013, assume that Goodyear is considering the following transactions. Treat each separately and compute how it would affect the company’s ratios of current assets divided by current liabilities and total liabilities divided by total shareholders’ equity.

1. Purchase $1,000 in inventory on account.

2. Issue common stock for $2,000 cash.

3. Refinance a $500 short-term liability with a $500 long-term liability.

4. Purchase equipment in exchange for a $400 long-term note payable.

5. Pay a $1,000 short-term debt with cash.

b. Assume that the terms of Goodyear’s long-term debt require the company to maintain a ratio of current assets divided by current liabilities of 1.55. Is this covenant restriction relevant to whether the company should enter into any of the above transactions? Explain.

c. How much cash could Goodyear pay for a long-term investment and still be in compliance with the covenant?

2012 2011 Current assets Long-term assets Total assets Current liabilities Long-term liabilities Shareholders' equity Total liabilities and $8,498 $9,812 7,817 $16,973 $17,629 $5,322 5,929 10,492 10,076 1,624 8,475 1,159 $16,973 $17,629 shareholders' equity Revenues Expenses Net income $20,992 20,780 $212

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

a Prior to the 5 transactions mentioned in the Exercise Goodyears current ratio and debtequity ratio... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

321-B-A-F-S (3742).docx

120 KBs Word File