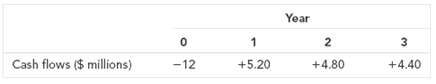

Question: Consider an asset with the following cash flows:The firm uses straight-line depreciation. Thus, for this project, it writes off $4 million per year in years

Consider an asset with the following cash flows:The firm uses straight-line depreciation. Thus, for this project, it writes off $4 million per year in years 1, 2, and 3. The discount rate is 10 percent.

a. Show that economic depreciation equals book depreciation.

b. Show that the book rate of return is the same in each year.

c. Show that the project?s book profitability is its true profitability.

You?ve just illustrated another interesting theorem. If the book rate of return is the same in each year of a project?s life, the book rate of return equals the IRR.

Year 1 2 3 Cash flows ($ millions) -12 +5.20 +4,80 +4.40

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Cash Flow PV at start of year PV at end of year Change in ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-C-B (168).docx

120 KBs Word File