Question: Consider the equation below that gives interest rate dynamics in a setting where the time axis [0, T] is subdivided into it equal intervals, each

Consider the equation below that gives interest rate dynamics in a setting where the time axis [0, T] is subdivided into it equal intervals, each of length ?:

rt+? = rt + ?rt + ?t(Wt+? ? Wt) + ?2(Wt ? Wt??)

where the random error terms

?Wt = (Wt+? - Wt)

are distributed normally as

?Wt ? N (0,?(?)).

(a) Explain the structure of the error terms in this equation. In particular, do you find it plausible that ?Wt-? may enter the dynamics of observed interest rates?

(b) Can you write a stochastic differential equation that will be the analog of this in continuous time? What is the difficulty?

(e) Now suppose you know, in addition, that long-term interest rates, R, move according to a dynamic given by

Rt+? = Rt + ?rt + ?1(Wt+? ? Wt) + ?2(Wt ? Wt??),

where we also know the covariance:

E[?W?W] = ??.

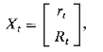

Can you write a representation for the vector process

such that Xt is a first-order Markov?(d) Can you write a continuous lime equivalent of this system?(e) Suppose short or long rates are individually non-Markov. Is it possible that they are jointly so?

, 3D R.

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Consider the two processes a This error structure is known as a moving average model of order 1 in t... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

41-B-F-F-M (66).docx

120 KBs Word File