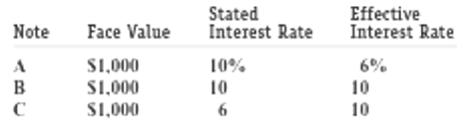

Question: Consider the three notes payable listed here. Each was issued on January 1, 2012, and matures on December 31, 2014. Interest payments are made annually

Consider the three notes payable listed here. Each was issued on January 1, 2012, and matures on December 31, 2014. Interest payments are made annually on December 31.

Required:

(a) Compute the present value of the remaining cash outflows for each note at each date:

Note 1/1/12 12/31/12 12/31/13

A

B

C

(b) Compute the balance sheet values of each note payable at each of the above dates, using the effective interest method.

(c) compute the balance sheet values of each note payable at each of the above dates, using the straight-line method (i.e., amortize an equal amount of the discount or premium each year).

(d) Why is the effective interest method preferred to the straight-line method for financial reported purpose?

Stated Interest Rate Effective Interest Rate Face Value Note S1,000 S1,000 S1,000 10% B 10 10 10

Step by Step Solution

3.17 Rating (167 Votes )

There are 3 Steps involved in it

a Note A 1112 123112 Present value i 6 n 3 Present value i 6 n 2 PV of face value PV of face value 1000 8396 83960 1000 8900 89000 PV of interest payment PV of interest payment 100 26730 26730 100 183... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-L (720).docx

120 KBs Word File