Question: A contractor is considering whether to purchase or lease a new machine for his layout site work. Purchasing a new machine will cost $12,000 with

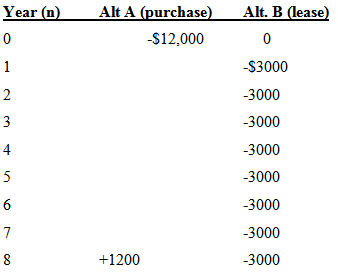

A contractor is considering whether to purchase or lease a new machine for his layout site work. Purchasing a new machine will cost $12,000 with a salvage value of $1200 at the end of the machine's useful life of 8 years. On the other hand, leasing requires an annual lease payment of $3000. Assuming that the MARR is 15% and on the basis of an internal rate of return analysis, which alternative should the contractor is advised to accept. The cash flows are follows:

Alt A (purchase) Year (n) Alt. B (lease) -$12,000 -$3000 -3000 3 -3000 -3000 -3000 -3000 -3000 +1200 -3000 7,

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Using incremental analysis computed the internal rate o... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (146).docx

120 KBs Word File