Question: Cost-plus target return on investment pricing. John Beck is the managing partner of a business that has just finished building a 60-room motel. Beck anticipates

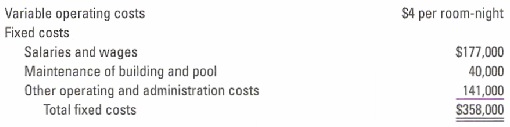

Cost-plus target return on investment pricing. John Beck is the managing partner of a business that has just finished building a 60-room motel. Beck anticipates that he will rent these rooms for 16,000 nights next year (or 16,000 room-nights). All rooms are similar and will rent for the same price. Beck estimates the following operating costs for next year:

The capital invested in the motel is $1,000,000. The partnership’s target return on investment is 25%. Beck expects demand for rooms to be uniform throughout the year. He plans to price the rooms at full cost plus a markup on full cost to earn the target return on investment.

1. What price should Beck charge for a room-night? What is the markup as a percentage of the full cost of a room-night?

2. Beck’s market research indicates that if the price of a room-night determined in requirement 1 is reduced by 10%, the expected number of room-nights Beck could rent would increase by 10%. Should Beck reduce prices by 10%? Show your calculations.

Variable operating costs Fixed costs Salaries and wages Maintenance of building and pool Other operating and administration costs Total fixed costs $4 per room-night $177,000 40,000 $358,000

Step by Step Solution

3.49 Rating (179 Votes )

There are 3 Steps involved in it

Costplus target return on investment pricing 1 2 If price is reduced by 10 the number of rooms Beck ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-B-M (65).docx

120 KBs Word File