Question: Credit Policy Evaluation Quest, Inc., is considering a change in its cash-only sales policy. The new terms of sale would be net one month. Based

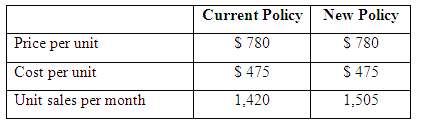

Credit Policy Evaluation Quest, Inc., is considering a change in its cash-only sales policy. The new terms of sale would be net one month. Based on the following information, determine if Quest should proceed or not. Describe the buildup of receivables in this case. The required return is 1.5 percent per month.

Current Policy New Policy Price per unit S 780 S 780 S 475 Cost per unit $ 475 1,420 Unit sales per month 1,505

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

The cost of switching is the lost sales from the existing policy plus the incr... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-F-P-M (81).docx

120 KBs Word File