Question: Delta Ltd has been developing a lightweight automated wheelchair. The research costs written off have been far greater than originally estimated and the equity and

Delta Ltd has been developing a lightweight automated wheelchair. The research costs written off have been far greater than originally estimated and the equity and preference capital has been eroded as seen on the statement of financial position.

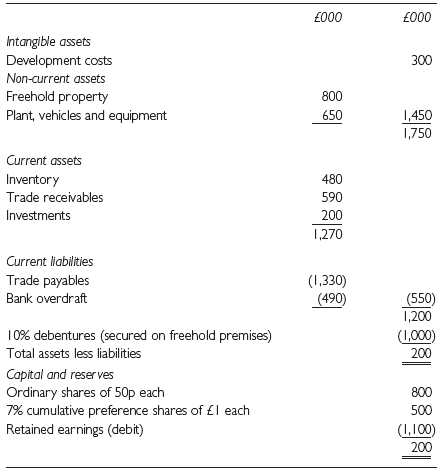

The following is the statement of financial position of Delta Ltd as at 31.12.20X9:

The finance director has prepared the following information for consideration by the board:

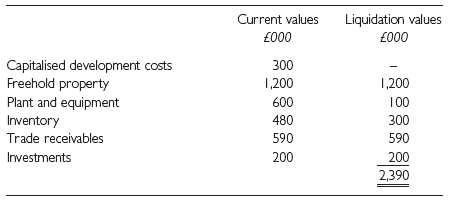

1. Estimated current and liquidation values were estimated as follows:

2. If the company were to be liquidated there would be disposal costs of £100,000.

3. The preference dividend had not been paid for five years.

4. It is estimated that the company would make profits before interest over the next five years of £150,000 rising to £400,000 by the fifth year.

5. The directors have indicated that they would consider introducing further equity capital.

6. It was the finance director’s opinion that for any scheme to succeed, it should satisfy the following conditions:

(a) The shareholders and creditors should have a better benefit in capital and income terms by reconstructing rather than liquidating the company.

(b) The scheme should have a reasonable possibility of ensuring the long-term survival of the company.

(c) There should be a reasonable assurance that there will be adequate working capital.

(d) Gearing should not be permitted to become excessive.

(e) If possible, the ordinary shareholders should retain control.

Required:

(a) Advise the unsecured creditors of the minimum that they should accept if they were to agree to a reconstruction rather than proceed to press for the company to be liquidated.

(b) Propose a possible scheme for reconstruction.

(c) Prepare the statement of financial position of the company as it would appear immediately after completion of thescheme.

000 000 Intangible assets Development costs 300 Non-current assets Freehold property Plant, vehicles and equipment 800 650 1,450 1,750 Current assets Inventory 480 Trade receivables 590 Investments 200 1,270 Current liabilities Trade payables (1,330) (550) 1,200 (490) Bank overdraft 1 0% debentures (secured on freehold premises) (1,000) Total assets less liabilities 200 Capital and reser ves Ordinary shares of 50p each 7% cumulative preference shares of 1 each Retained earnings (debit) 800 500 (1,100) 200

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

a The unsecured creditors would consider the amount available to them after the secured creditors ha... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

168-B-A-G-F-A (1050).docx

120 KBs Word File