Diana, a partner in the cash basis HDA Partnership, has a one-third interest in partnership profits and

Question:

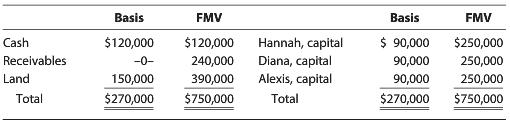

Diana, a partner in the cash basis HDA Partnership, has a one-third interest in partnership profits and losses. The partnership’s balance sheet at the end of the current year is as follows:

Diana sells her interest in the HDA Partnership to Kenneth at the end of the current year for cash of $250,000.

a. How much income must Diana report on her tax return for the current year from the sale? What is its nature?

b. If the partnership does not make an optional adjustment-to-basis election, what are the type and amount of income that Kenneth must report in the next year when the receivables are collected?

c. If the partnership did make an optional adjustment-to-basis election, what are the type and amount of income that Kenneth must report in the next year when the receivables are collected? When the land (which is used in the HDA Partnership’s business) is sold for $420,000? Assume that no other transactions occurred that year.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney