Question: Do problem 1 over again, this time assuming more realistically that a swap bank is involved as an intermediary. Assume the swap bank is quoting

Do problem 1 over again, this time assuming more realistically that a swap bank is involved as an intermediary. Assume the swap bank is quoting five-year dollar interest rate swaps at 10.7% - 10.8% against LIBOR flat.

Problem 1

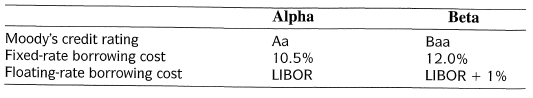

Alpha and Beta Companies can borrow for a five-year term at the following rates:

Beta Alpha Aa 10.5% LIBOR Moody's credit rating Fixed-rate borrowing cost Floating-rate borrowing cost Baa 12.0% LIBOR + 1%

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Alpha will issue fixedrate debt at 105 and Beta will issue floating ratedebt at LIBOR 1 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

97-B-F-I-F-M (218).docx

120 KBs Word File