Question: During 2015, the Smiths and the Joneses both filed joint tax returns. For the tax year ended December 31, 2015, the Smiths' taxable income was

During 2015, the Smiths and the Joneses both filed joint tax returns. For the tax year ended December 31, 2015, the Smiths' taxable income was $130,000, and the Joneses had total taxable income of $65,000.

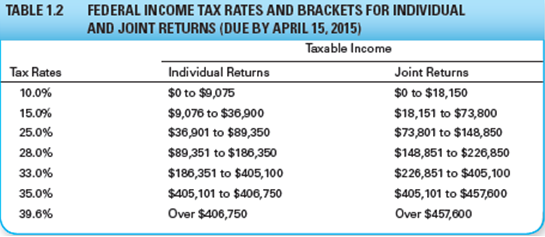

a. Using the federal tax rates given in Table 1.2 for married couples filing joint returns, calculate the taxes for both the Smiths and the Joneses.

b. Calculate and compare the ratio of the Smiths' to the Joneses' taxable income and the ratio of the Smiths' to the Joneses' taxes. What does this demonstrate about the federal income tax structure?

TABLE 1.2 FEDERAL INCOME TAX RATES AND BRACKETS FOR INDIVIDUAL AND JOINT RETURNS (DUE BY APRIL 15, 2015) Taxable Income Tax Rates 10.0% 15.0% 25.0% 28.0% 33.0% 35.0% 39.6% Individual Returns $0 to $9,075 $9,076 to $36,900 $36,901 to $89,350 $89,351 to $186,350 $186,351 to $405,100 $405,101 to $406,750 Over $406,750 Joint Returns $0 to $18,150 $18,151 to $73,800 $73,801 to $148,850 $148,851 to $226,850 $226,851 to $405,100 $405,101 to $457600 Over $457,600

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

a Tax on the Smiths income of 130000 Looking at the ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1136-B-C-F-B-V(1591).docx

120 KBs Word File