Question: Each team member has the responsibility to become an expert on an inventory method. This expertise will be used to facilitate teammates understanding of the

Each team member has the responsibility to become an expert on an inventory method.

This expertise will be used to facilitate teammates’ understanding of the concepts relevant to that method.

1. Each learning team member should select an area for expertise by choosing one of the following inventory methods: specific identification, LIFO, FIFO, or weighted average.

2. Form expert teams made up of students who have selected the same area of expertise. The instructor will identify where each expert team will meet.

3. Using the following data, each expert team must collaborate to develop a presentation that illustrates the relevant concepts and procedures for its inventory method. Each team member must write the presentation in a format that can be shown to the learning team.

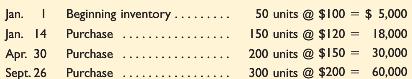

Data The Company uses a perpetual inventory system. It had the following beginning inventory and current year purchases of its product.

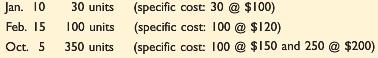

The company transacted sales on the following dates at a $350 per unit sales price.

Concepts and Procedures to Illustrate in Expert Presentation

a. Identify and compute the costs to assign to the units sold. (Round per unit costs to three decimals.)

b. Identify and compute the costs to assign to the units in ending inventory. (Round inventory balances to the dollar.)

c. How likely is it that this inventory costing method will reflect the actual physical flow of goods? How relevant is that factor in determining whether this is an acceptable method to use?

d. What is the impact of this method versus others in determining net income and income taxes?

e. How closely does the ending inventory amount reflect replacement cost?

4. Re-form learning teams. In rotation, each expert is to present to the team the presentation developed in part 3. Experts are to encourage and respond to questions.

Jan. 1 Beginning inventory Jan. 14 Purchase Apr. 30 Purchase Sept 26 Purchase 50 units $100 5,000 150 units@ $12018,000 200 units @ $150 30.000 Jan. 0 30 units (specific cost 30 $100) Feb. 15 100 units (specific cost: 100@ $120) Oct. 5 350 units (specific cost: 100 $150 and 250 @ $200)

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Specific Identification Expert a and b Concept Purchases are always recorded at the actual specific costs The specific identification cost flow assumption requires units sold be assigned their actual ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

422-B-M-A-I (2865).docx

120 KBs Word File