Question: Effect of alternative transfer-pricing methods on division operating income. Crango Products is a cranberry cooperative that operates two divisions: a Harvesting Division and a Processing

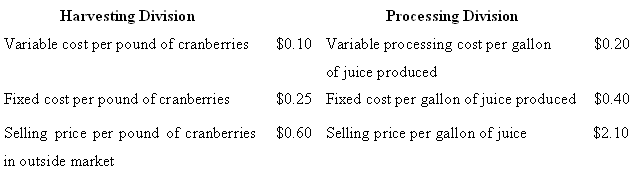

Effect of alternative transfer-pricing methods on division operating income. Crango Products is a cranberry cooperative that operates two divisions: a Harvesting Division and a Processing Division. Currently, all of Harvesting’s output is converted into cranberry juice by the Processing Division, and the juice is sold to large beverage companies that produce cranberry juice blends. The Processing Division has a yield of 500 gallons of juice per 1,000 pounds of cranberries. Cost and market price data for the two divisions are as follows:

1. Compute Crango’s operating income from harvesting 400,000 pounds of cranberries during June 2009 and processing them into juice.

2. Crango rewards its division managers with a bonus equal to 5% of operating income. Compute the bonus earned by each division manager in June 2009 for each of the following transfer pricing methods:

a. 200% of full cost

b. Market price

3. Which transfer-pricing method will each division manager prefer? How might Crango resolve any conflicts that may arise on the issue of transfer pricing?

Harvesting Division Processing Division Variable cost per pound of cranberries $0.10 Variable processing cost per gallon of juice produced $0.25 Fixed cost per gallon of juice produced $0.20 Fixed cost per pound of cranberries $0.40 Selling price per pound of cranberries $0.60 Selling price per gallon of juice $2.10 in outside market

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Effect of alternative transferpricing methods on division operating income 1 2 3 Bonus paid to divis... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-M-C-M-I (45).docx

120 KBs Word File