Question: ELN Waste Management has a subsidiary that disposes of hazardous waste and a subsidiary that collects and disposes of residential garbage. Information related to the

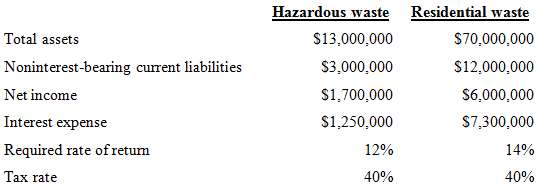

ELN Waste Management has a subsidiary that disposes of hazardous waste and a subsidiary that collects and disposes of residential garbage. Information related to the two subsidiaries follows.

Requireda. Calculate ROI for both subsidiaries.b. Calculate EVA for both subsidiaries. Note that since no adjustments for accounting distortions are being made, EVA is equivalent to residual income.c. Which subsidiary has added the most to shareholder value in the last year? d. Based on the limited information, which subsidiary is the best candidate for expansion? Explain.

Hazardous waste $13,000,000 S3,000,000 S1,700,000 S1,250,000 12% 40% Residential waste Total assets Noninterest-bearing current liabilities Net income Interest expense Required rate of retum Tax rate $70,000,000 $12,000,000 S6,000,000 $7,300,000 14% 4000

Step by Step Solution

3.49 Rating (185 Votes )

There are 3 Steps involved in it

a Hazardous waste Residential waste Operating income 4083333 net income1 40 1250000 1730000... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

68-B-C-A-C-P-A (538).docx

120 KBs Word File