Question: Examine Hoffman Companys simplified income statement based on variable costing. Assume that the budgeted volume for absorption costing in 20X0 and 20X1 was 1,470 units

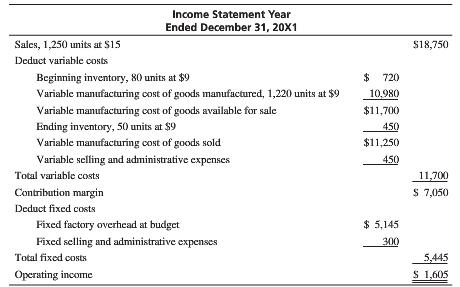

Examine Hoffman Company’s simplified income statement based on variable costing. Assume that the budgeted volume for absorption costing in 20X0 and 20X1 was 1,470 units and that total fixed costs were identical in 20X0 and 20X1. There is no beginning or ending work in process.

1. Prepare an income statement based on absorption costing. Assume that actual fixed costs were equal to budgeted fixed costs.

2. Explain the difference in operating income between absorption costing and variable costing.

Be specific.

Income Statement Year Ended December 31, 20X1 Sales, 1,250 units at S15 Deduct variable costs $18,750 Beginning inventory, 80 units at $9 720 Vaiable manufacturing cost of goods manufactured, 1,220 units at $9 0980 $11,700 450 $11,250 ariable manufacturin Ending inventory, 50 units at S9 Variable Variable selling and administrative expenses g cost of goods available for sale manufacturing cost of goods solod Total variable costs Contribution margin Deduct fixed costs 11,700 S 7,050 Fixed factory overhead at budget Fixed selling and administrative expenses 5,145 Total fixed costs 5,445 Operating income S 1,605

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

1 2 Change in inventory units 80 50 30 decrease Fixed factory overhead rate i... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

345-B-C-A-P-C (208).docx

120 KBs Word File