Question: Examine Nikes segments as defined in Note 18 to its financial statements in the 10-K report in Appendix C. We will use the segment information

Examine Nike’s segments as defined in Note 18 to its financial statements in the 10-K report in Appendix C. We will use the segment information from the first six segments listed to calculate approximations to ROI and economic profit. For purposes of this problem, define segment income as segment EBIT and define segment assets as the sum of the assets shown in note 18, namely receivables, inventory, and property plant and equipment. Therefore, pretax and pre-interest ROA is EBIT divided by segment assets and an approximation to economic profit is EBIT minus a charge for the cost of capital to finance segment assets.

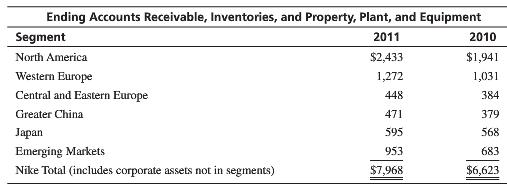

Using these definitions, determine ROA and economic profit for each segment in 2010 and 2011 using EBIT from Note 18 in the 10-K and the information on segment assets in the following table. Assume that Nike’s cost of capital is 10%. Use your results to evaluate the performance of each segment. Which segment management seems to be doing the best job? What subjective factors would you consider, in addition to ROA and economic profit, in assessing segment performance?

Ending Accounts Receivable, Inventories, and Property, Plant, and Equipment Segment 2011 2010 North America $2,433 $1,941 Western Europe 1,272 1,031 Central and Eastern Europe 448 384 Greater China 471 379 Japan 595 568 Emerging Markets Nike Total (includes corporate assets not in segments) 953 683 $7,968 $6,623

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

All amounts in this solution except percentages are in millions of dollars The North America segment produced the most economic profit both years and ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

345-B-M-A-B-P-C (1593).docx

120 KBs Word File