Question: Examine the control risk matrix in Figure 8.6. Explain the purpose of the matrix. Also explain the meaning and effect of an assessment of control

Examine the control risk matrix in Figure 8.6. Explain the purpose of the matrix. Also explain the meaning and effect of an assessment of control risk of low compared with one of medium.

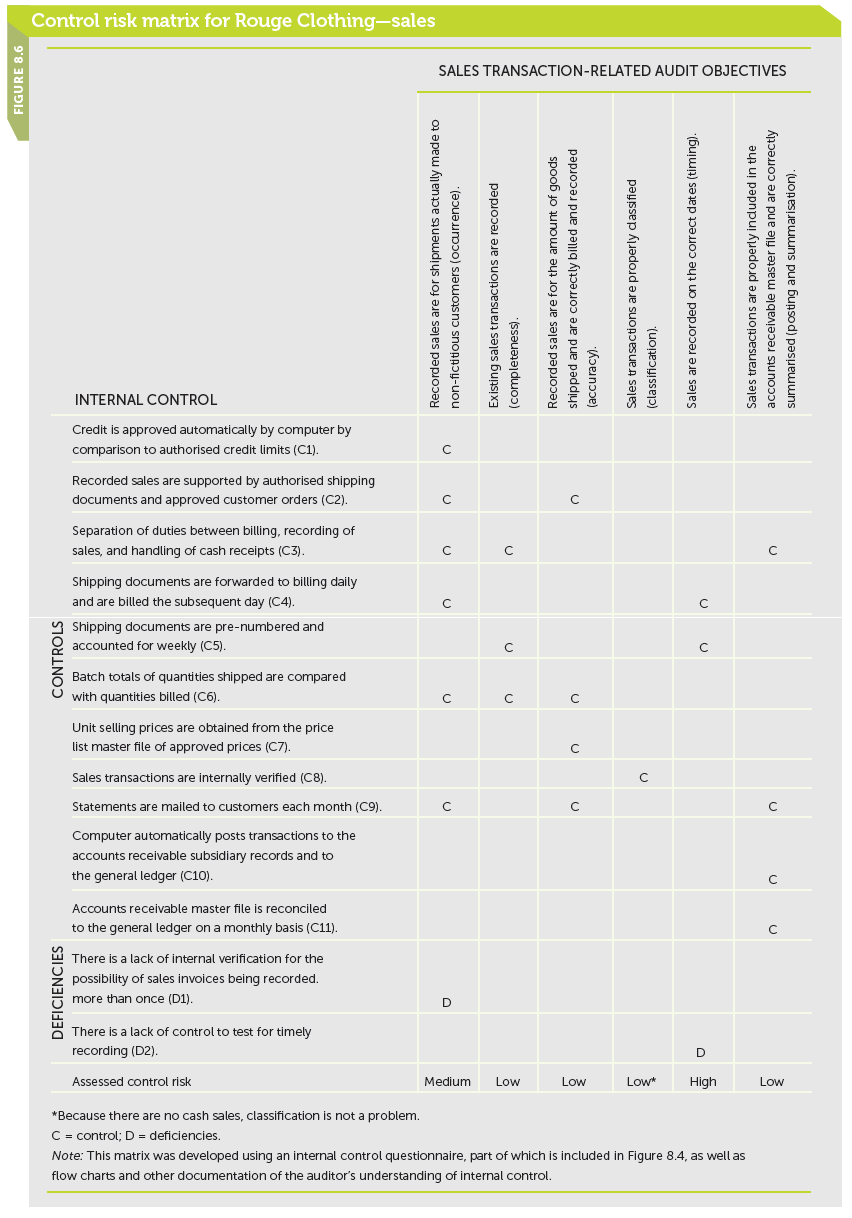

Control risk matrix for Rouge Clothing-sales SALES TRANSACTION-RELATED AUDIT OBJECTIVES INTERNAL CONTROL Credit is approved automatically by computer by comparison to authorised credit limits (C1). Recorded sales are supported by authorised shipping documents and approved customer orders (C2). Separation of duties between billing, recording of sales, and handling of cash receipts (C3). Shipping documents are forwarded to billing daily and are billed the subsequent day (C4). 4 Shipping documents are pre-numbered and accounted for weekly (C5). Batch totals of quantities shipped are compared with quantities billed (C6). Unit selling prices are obtained from the price list master file of approved prices (C7). Sales transactions are internally verified (C8). Statements are mailed to customers each month (C9). Computer automatically posts transactions to the accounts receivable subsidiary records and to the general ledger (C10). Accounts receivable master file is reconciled to the general ledger on a monthly basis (C11). There is a lack of internal verification for the possibility of sales invoices being recorded. more than once (D1). D There is a lack of control to test for timely recording (D2). D. Assessed control risk Medium Low Low Low* High Low *Because there are no cash sales, classification is not a problem. C = control; D = deficiencies. Note: This matrix was developed using an internal control questionnaire, part of which is included in Figure 8.4, as well as flow charts and other documentation of the auditor's understanding of internal control. FIGURE 8.6 DEFICIENCIES CONTROLS Recorded sales are for shipments actually made to non-fictitious customers (ocaurrence). Existing sales transactions are recorded (completeness. Recorded sales are for the amount of goods shipped and are correctly billed and recorded (accuracy). Sales transactions are properiy dassiled (classification). Sales are recorded on the correct dates (timing). Sales transactions are properly induded in the accounts receivable master file and are correctiy summarised (postng and summarisaton).

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

The purpose of the control risk matrix is to assist th... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1200-B-A-A-A-N(5042).docx

120 KBs Word File