Question: Excerpts from the 2012 financial statements for Goodyear are as follows (dollars in millions): REQUIRED: Assume that you have some capital to invest and that

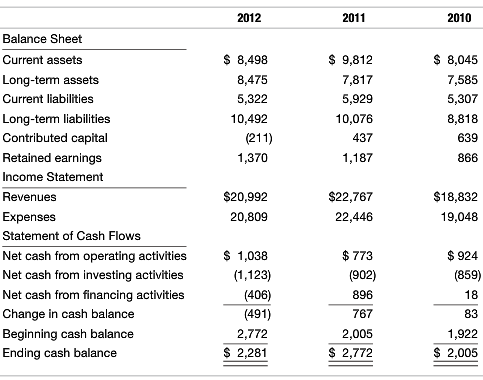

Excerpts from the 2012 financial statements for Goodyear are as follows (dollars in millions):

REQUIRED:

Assume that you have some capital to invest and that you are considering an equity investment in Goodyear. Review the financial statements and comment on Goodyear as an investment. Support your recommendation with financial ratios. Assume a tax rate of 30 percent. Interest expense is $316 in 2010, $330 in 2011, and $357 in 2012.

2012 2011 2010 Balance Sheet $ 8,498 $ 9,812 Current assets 8,045 Long-term assets 8,475 7,817 7,585 Current liabilities 5,322 5,929 5,307 Long-term liabilities 10,492 10,076 8,818 Contributed capital (211) 437 639 Retained earnings 1,370 1,187 866 Income Statement $20,992 $2,767 $18,832 Revenues Expenses 20,809 22,446 19,048 Statement of Cash Flows $ 1,038 $ 773 $ 924 Net cash from operating activities (859) Net cash from investing activities (1,123) (902) 896 Net cash from financing activities (406) 18 (491) Change in cash balance 767 83 Beginning cash balance 2,772 2,005 1,922 $ 2,281 $ 2,772 $ 2,005 Ending cash balance

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

In order to consider an investment in Goodyear let us first compute the following ratios 1 Return on ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

321-B-A-F-S (3774).docx

120 KBs Word File