Question: (Explain Future Taxable and Deductible Amounts, How Carry back and Carry forward Affects Deferred Taxes) Maria Rodriquez and Lynette Kingston are discussing accounting for income

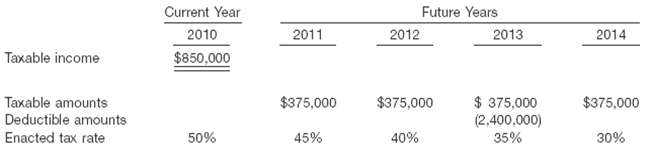

(Explain Future Taxable and Deductible Amounts, How Carry back and Carry forward Affects Deferred Taxes) Maria Rodriquez and Lynette Kingston are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule is as follows.

(a) Explain the concept of future taxable amounts and future deductible amounts as illustrated in the schedule.

(b) How do the carry back and carry forward provisions affect the reporting of deferred tax assets and deferred taxliabilities?

Taxable income Taxable amounts Deductible amounts Enacted tax rate Current Year 2010 $850,000 50% 2011 $375,000 45% 2012 Future Years $375,000 40% 2013 $375,000 (2,400,000) 35% 2014 $375,000 30%

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

a Future taxable amounts increase taxable income relative to pretax financial income in the future due to temporary differences existing at the balanc... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-I-T (72).docx

120 KBs Word File