Question: Financial information for Chimera Company is presented here. Additional information:1. Inventory at the beginning of 2011 was $330,000.2. Receivables at the beginning of 2011 were

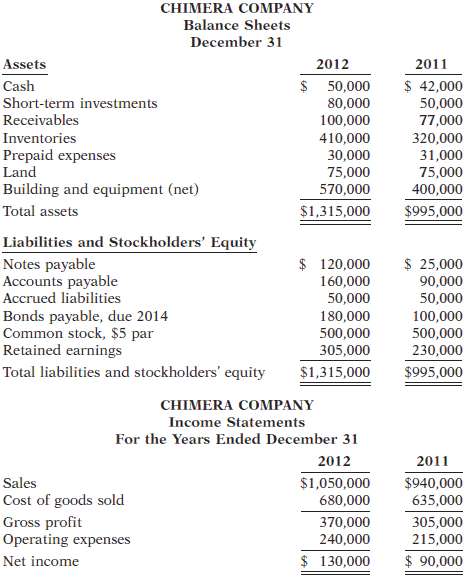

Financial information for Chimera Company is presented here.

Additional information:1. Inventory at the beginning of 2011 was $330,000.2. Receivables at the beginning of 2011 were $80,000.3. Total assets at the beginning of 2011 were $1,175,000.4. No common stock transactions occurred during 2011 or 2012.5. All sales were on account.Instructions(a) Indicate, by using ratios, the change in liquidity and profitability of the company from 2011 to 2012. (Note: Not all profitability ratios can be computed nor can cashbasis ratios be computed.)(b) Given below are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2012, and (2) as of December 31, 2013, after giving effect to the situation. Net income for 2013 was $125,000. Total assets on December 31, 2013, were $1,450,000.

CHIMERA COMPANY Balance Sheets December 31 2011 Assets 2012 $ 50,000 80,000 $ 42,000 50,000 77,000 Cash Short-term investments Receivables 100,000 Inventories 410,000 320,000 Prepaid expenses Land Building and equipment (net) 30,000 31,000 75,000 75,000 570,000 400,000 Total assets $1,315,000 $995,000 Liabilities and Stockholders' Equity $ 120,000 160,000 $ 25,000 90,000 Notes payable Accounts payable Accrued liabilities 50,000 50,000 Bonds payable, due 2014 Common stock, $5 par Retained earnings Total liabilities and stockholders' equity 180,000 100,000 500,000 500,000 305,000 230,000 $995,000 $1,315,000 CHIMERA COMPANY Income Statements For the Years Ended December 31 2012 2011 Sales Cost of goods sold $940,000 $1,050,000 680,000 635,000 Gross profit Operating expenses 370,000 305,000 215,000 240,000 $ 130,000 $ 90,000 Net income

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

a LIQUIDITY An overall decrease in shortterm liquidit... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-A-F-A (150).docx

120 KBs Word File