Question: Find the prospectus for a recent IPO. How do the issue costs compare with (a) Those of the Marvin issue and (b) Those shown in

Find the prospectus for a recent IPO. How do the issue costs compare with

(a) Those of the Marvin issue and

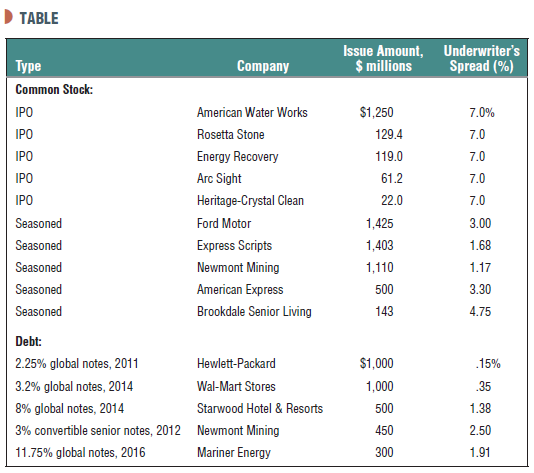

(b) Those shown in Table?

Can you suggest reasons for the differences?

D TABLE Issue Amount, $ millions Underwriter's Spread (%) Type Company Common Stock: IPO $1,250 American Water Works 7.0% IPO Rosetta Stone 129.4 7.0 IPO Energy Recovery 119.0 7.0 61.2 IPO Arc Sight 7.0 IPO 22.0 7.0 Heritage-Crystal Clean Seasoned Ford Motor 1,425 3.00 Seasoned Express Scripts 1,403 1.68 Newmont Mining Seasoned 1,110 1.17 Seasoned American Express 500 3.30 Brookdale Senior Living Seasoned 143 4.75 Debt: $1,000 2.25% global notes, 2011 Hewlett-Packard 15% 1,000 3.2% global notes, 2014 Wal-Mart Stores 35 8% global notes, 2014 Starwood Hotel & Resorts 500 1.38 3% convertible senior notes, 2012 Newmont Mining 450 2.50 Mariner Energy 11.75% global notes, 2016 300 1.91

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Some possible reasons for cost differences a Large issue... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

214-B-C-F-F-D (443).docx

120 KBs Word File