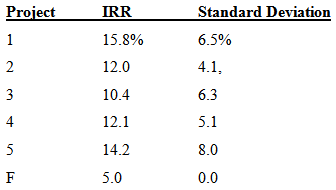

Question: A firm wants to select one new research and development project. The following table summarizes six possibilities. Considering expected return and risk, which projects are

A firm wants to select one new research and development project. The following table summarizes six possibilities. Considering expected return and risk, which projects are good candidates? The firm believes it can earn 5% on a risk-free investment in government securities (labeled as Project F).

Standard Deviation Project IRR 6.5% 15.8% 4.1, 12.0 3 10.4 6.3 4 12.1 5.1 14.2 8.0 5.0 0.0

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (309).docx

120 KBs Word File