Question: Florze Software Inc. (Florze) is a software development company located in Kanata, Ontario. Software is a highly competitive industry and the life of a software

Florze Software Inc. (Florze) is a software development company located in Kanata, Ontario. Software is a highly competitive industry and the life of a software product is usually quite short. To remain competitive, companies must invest heavily in research and development to keep their existing products up to date and to develop new ones. Florze expenses all research costs and any development costs that don't meet the criteria for capitalization.

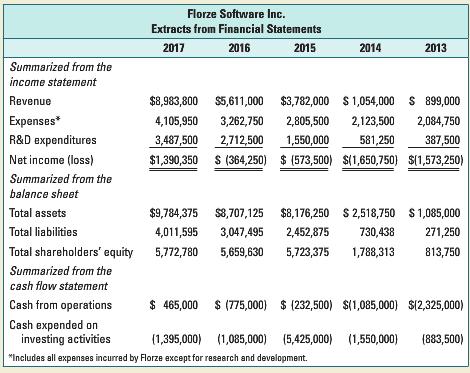

Florze has never capitalized any development costs. Florze has incurred no interest expense over the past five years. The following information has been summarized from Florze's financial statements:

Required:

a. Recalculate net income for 2015 through 2017, assuming that R&D costs were capitalized and amortized over three years using straight-line amortization beginning in 2013.

b. What would total assets be at the end of 2015 through 2017 if R&D costs were capitalized and amortized over three years?

c. What would shareholders' equity be at the end of 2015 through 2017 if R&D costs were capitalized and amortized over three years?

d. What would cash from operations and cash expended on investing activities be for 2015 through 2017 if R&D costs were capitalized and amortized over three years?

e. What would the following ratios be assuming that (1) R&D costs were expensed as incurred and (2) R&D costs were capitalized and expensed over three years? Assume that Florze didn't have an interest expense over the period 2013-2017.

i. Return on assets

ii. Debt-to-equity ratio

iii. Profit margin percentage

f. How would your interpretation of Florze differ depending on how R&D costs are accounted for? Which accounting approach do you think is more appropriate? Explain. Your answer should consider the objectives of the stakeholders and the managers who prepare the accounting information, as well as the accounting concepts discussed throughout the book.

Florze Software Inc. Extracts from Financial Statements 2017 2016 2015 2014 2013 Summarized from the income statement Revenue $8,983,800 $5,611,000 $3,782,000 $1,054,000 $ 899,000 Expenses* 4,105,950 3,262,750 2,805,500 2,123,500 2,084,750 R&D expenditures 3,487,500 2,712,500 1,550,000 581,250 387,500 Net income (loss) $1,390,350 $ (364,250) $ (573,500) S(1,650,750) S(1,573,250) Summarized from the balance sheet Total assets $9,784,375 $8,707,125 $8,176,250 $2,518,750 $1,085,000 Total liabilities 4,011,595 3,047,495 2,452,875 730,438 271,250 Total shareholders' equity 5,772,780 5,659,630 5,723,375 1,788,313 813,750 Summarized from the cash flow statement Cash from operations $ 465,000 $ $ (775,000) $ (232,500) $(1,085,000) $(2,325,000) Cash expended on investing activities (1,395,000) (1,085,000) (5,425,000) (1,550,000) (883,500) *Includes all expenses incurred by Florze except for research and development.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

2017 2016 2015 2014 R D expenditures 3487500 2712500 1550000 581250 depreciation 3 years 1162500 904167 516667 193750 Revenues 8983800 5611000 3782000 1054000 Other Expenses 4105950 3262750 2805500 21... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

408-B-A-I-A (4924).docx

120 KBs Word File