Question: For the year ended June 30, 2009, A.E.G. Enterprises presented the financial statements shown below. Early in the new fiscal year, the officers of the

For the year ended June 30, 2009, A.E.G. Enterprises presented the financial statements shown below. Early in the new fiscal year, the officers of the firm formalized a substantial expansion plan. The plan will increase fixed assets by $190 million. In addition, extra inventory will be needed to support expanded production. The increase in inventory is purported to be $10 million. The firm's investment bankers have suggested the following three alternative financing plans:

Plan A: Sell preferred stock at par, 5%.

Plan B: Sell common stock at $10 per share.

Plan C: Sell long-term bonds, due in 20 years, at par ($1,000), with a stated interest rate of 8%.

Required

a. For the year ended June 30, 2009, compute:

1. Times interest earned

2. Debt ratio

3. Debt/equity ratio

4. Debt to tangible net worth ratio

b. Assuming the same financial results and statement balances, except for the increased assets and financing, compute the same ratios as in (a) under each financing alternative. Do not attempt to adjust retained earnings for the next year's profits.

c. Changes in earnings and number of shares will give the following earnings per share: Plan A'0.73, Plan B'0.69, and Plan C'0.73. Based on the information given, discuss the advantages and disadvantages of each alternative.

d. Why does the 5% preferred stock cost the company more than the 8%bonds?

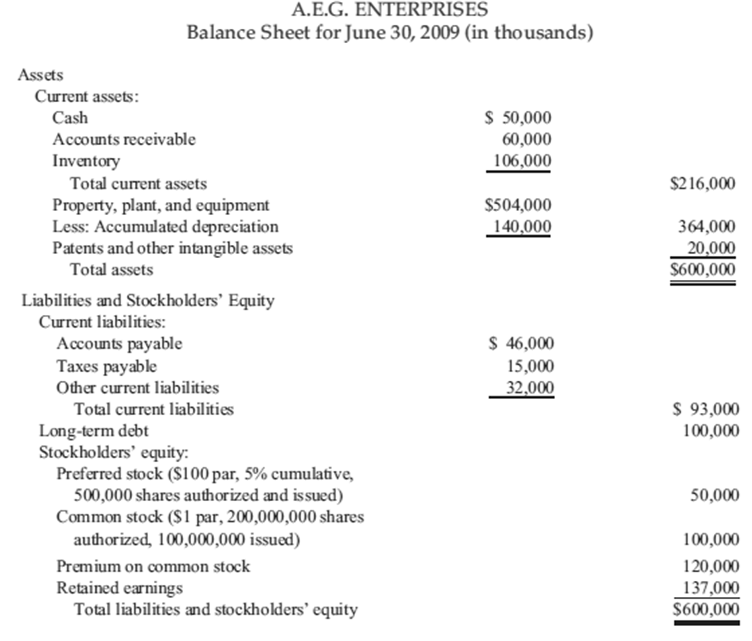

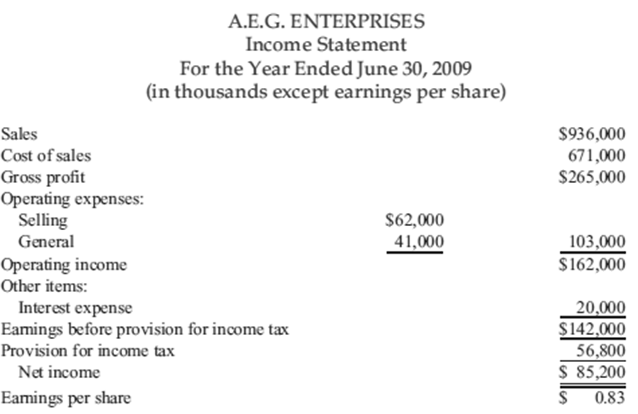

A.E.G. ENTERPRISES Balance Sheet for June 30, 2009 (in thousands) Assets Current assets Cash Accounts receivable Inventory S 50,000 60,000 106,000 Total current assets Property, plant, and equipment Less: Accumulated depreciation Patents and other intangible assets $216,000 $504,000 140,000 364,000 20,000 $600,000 Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Taxes payable Other current liabilities S 46,000 15,000 32,000 Total current liabilities $ 93,000 100,000 Long-term debt Stockholders' equity: Preferred stock ($100 par, 5% cumulative, 500,000 shares authorized and issued) Common stock (S1 par, 200,000,000 shares 50,000 authorized, 100,000,000 issued) Premium on common stock Retained earnings 100,000 120,000 137,000 $600,000 Total liabilities and stockholders' equity A.E.G. ENTERPRISES Income Statement For the Year Ended June 30, 2009 (in thousands except earnings per share) Sales Cost of sales Gross profit Operating expenses: $936,000 671,000 $265,000 Selling $62,000 41,000 General Operating income Other items: 103,000 $162,000 20,000 Interest expense Eamings before provision for income tax Provision for income tax 56,800 S 85,200 S 0.83 Net income Eamings per share

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

a 1 Times Interest Earned Recurring Earnings Excluding Interest Expense Tax Expense Equity Earnings and Noncontrolling Interest Interest Expense Including Capitalized Interest 162000 81 times per year ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

139-B-A-L (1976).docx

120 KBs Word File