Question: For the year ending August 31, 2011, Gymboree Systems Inc. reported net income of $90,600 and paid dividends of $27,000. Comparative balance sheets as of

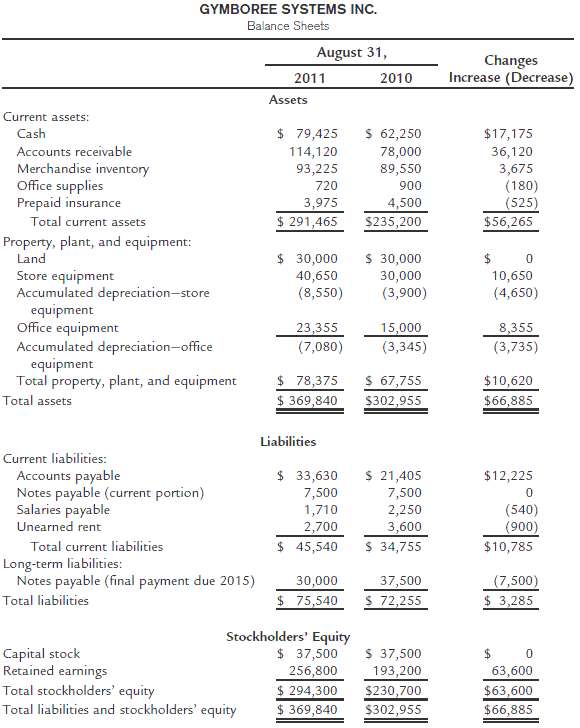

For the year ending August 31, 2011, Gymboree Systems Inc. reported net income of $90,600 and paid dividends of $27,000. Comparative balance sheets as of August 31, 2011 and 2010, are as follows:

Instructions1. Prepare a statement of cash flows, using the indirect method.2. Why is depreciation added to net income in determining net cash flows from operating activities?Explain.

GYMBOREE SYSTEMS INC. Balance Sheets August 31, Changes Increase (Decrease) 2010 2011 Assets Current assets: $ 79,425 $ 62,250 Cash $17,175 Accounts receivable 114,120 78,000 89,550 36,120 Merchandise inventory Office supplies Prepaid insurance 93,225 3,675 (180) (525) $56,265 720 900 3,975 $ 291,465 4,500 Total current assets $235,200 Property, plant, and equipment: Land $ 30,000 $ 30,000 Store equipment Accumulated depreciation-store equipment Office equipment Accumulated depreciation-office equipment Total property, plant, and equipment 10,650 (4,650) 40,650 30,000 (3,900) (8,550) 23,355 (7,080) 15,000 (3,345) 8,355 (3,735) $ 67,755 $302,955 $ 78,375 $ 369,840 $10,620 Total assets $66,885 Liabilities Current liabilities: $ 33,630 $ 21,405 7,500 Accounts payable Notes payable (current portion) Salaries payable Unearned rent $12,225 7,500 1,710 2,700 (540) (900) 2,250 3,600 $ 34,755 $ 45,540 Total current liabilities $10,785 Long-term liabilities: Notes payable (final payment due 2015) 30,000 $ 75,540 37,500 S 72,255 (7,500) $ 3,285 Total liabilities Stockholders' Equity $ 37,500 $ 37,500 193,200 $230,700 Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 63,600 $63,600 256,800 $ 294,300 $ 369,840 $302,955 $66,885

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

1 2 Depreciation is added to net income in determining net cash flows from operating activities beca... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-A-M-B (401).docx

120 KBs Word File