Funtime, Inc., manufactures video game machines. Market saturation and technological innovations caused pricing pressures that resulted in

Question:

Funtime, Inc., manufactures video game machines. Market saturation and technological innovations caused pricing pressures that resulted in declining profits. To stem the slide in profits until new products can be introduced, top management turned its attention to both manufacturing economics and increased production. To realize these objectives, management developed an incentive program to reward production managers who contribute to an increase in the number of units produced and a decrease in costs. The production managers responded to the pressure of improving manufacturing in several ways that increased the number of completed units beyond normal production levels. The assembly group puts together video game machines that require parts from both the printed circuit boards (PCB) and the reading heads (RH) groups. To attain increased production levels, the PCB and RH groups began rejecting parts that previously would have been tested and modified to meet manufacturing standards. Preventive maintenance on machines used to produce these parts has been postponed; only emergency repair work is being performed to keep production lines moving. The maintenance department is concerned about serious breakdowns and unsafe operating conditions. The more aggressive assembly group production supervisors pressured maintenance personnel to attend to their machines rather than those of other groups. This resulted in machine downtime in the PCB and RH groups that, when coupled with demands for accelerated parts delivery by the assembly group, led to more frequent rejection of parts and increased friction among departments.

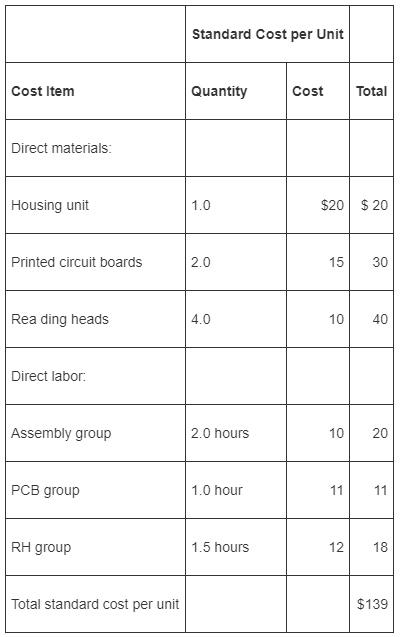

Funtime operates under a standard cost system. The standard costs per video game machine are as follows:

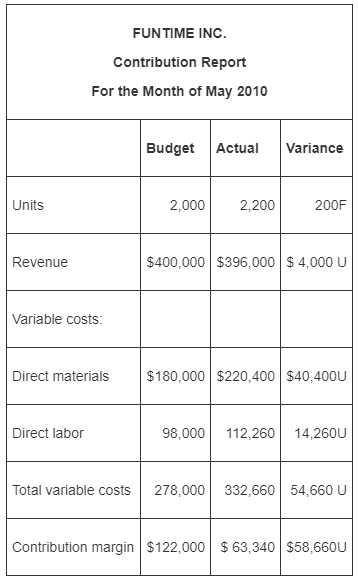

Funtime prepares monthly performance reports based on standard costs. The following is the contribution report for May 2010 when production and sales both reached 2,200 units.

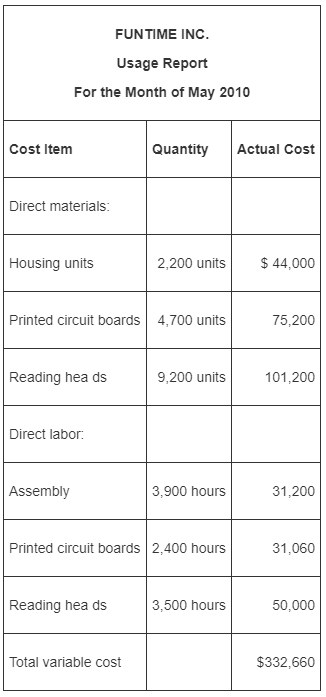

Funtime’s top management was surprised by the unfavorable contribution margin variance in spite of the increased sales in May. Constance Brown, the firm’s cost accountant, was asked to identify and report on the reasons for the unfavorable contribution margin as well as the individuals or groups responsible for them. After her review, Constance prepared the following usage report:

Constance reported that the PCB and RH groups supported the increased production levels but experienced abnormal machine downtime, causing idle time that required the use of overtime to keep up with the accelerated demand for parts. This overtime was charged to direct labor. She also reported that the production managers of these two groups resorted to parts rejections, rather than testing and modifying them, as was done routinely in the past. Constance determined that the assembly group met management’s objectives by increasing production while utilizing fewer-than-standard hours.

Required

1. Set up an Excel spreadsheet to calculate the following variances:

a. Direct material price variance, calculated at point of production.

b. Direct material usage variance.

c. Direct labor efficiency variance.

d. Direct labor rate variance.

e. Selling price variance.

f. Sales volume variance, in terms of contribution margin.

2. Determine the components of the $58,660 unfavorable variance between budgeted and actual contribution margin during May 2010.

3. Identify and briefly explain the behavioral factors that could promote friction among the production managers and between them and the maintenance manager.

4. Evaluate Constance Brown’s analysis of the unfavorable contribution results in terms of the report’s completeness and its effect on the behavior of the production groups.

Contribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins