Gabelli Corporation was formed on January 1, 2012. At December 31, 2012, John Paulus, the president and

Question:

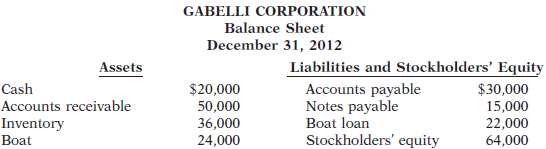

Gabelli Corporation was formed on January 1, 2012. At December 31, 2012, John Paulus, the president and sole stockholder, decided to prepare a balance sheet, which appeared as follows.

John willingly admits that he is not an accountant by training. He is concerned that his balance sheet might not be correct. He has provided you with the following additional information.1. The boat actually belongs to Paulus, not to Gabelli Corporation. However, because he thinks he might take customers out on the boat occasionally, he decided to list it as an asset of the company. To be consistent, he also listed as a liability of the corporation his personal loan that he took out at the bank to buy the boat.2. The inventory was originally purchased for $25,000, but due to a surge in demand John now thinks he could sell it for $36,000. He thought it would be best to record it at $36,000.3. Included in the accounts receivable balance is $10,000 that John loaned to his brother 5 years ago. John included this in the receivables of Gabelli Corporation so he wouldn??t forget that his brother owes him money.Instructions(a) Comment on the proper accounting treatment of the three items above.(b) Provide a corrected balance sheet for Gabelli Corporation.

Step by Step Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso