Question: Gerber Electronics manufactures two large-screen television models: the Royale, which sells for $1,500, and a new model, the Majestic, which sells for $1,200. The production

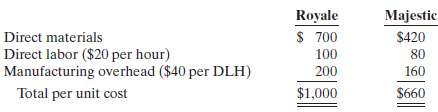

Gerber Electronics manufactures two large-screen television models: the Royale, which sells for $1,500, and a new model, the Majestic, which sells for $1,200. The production cost per unit for each model in 2012 is shown on the next page.

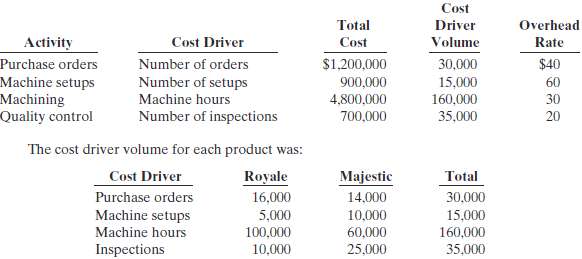

In 2012, Gerber manufactured 30,000 units of the Royale and 10,000 units of the Majestic. The overhead rate of $40 per direct labor hour was determined by dividing total expected manufacturing overhead of $7,600,000 by the total direct labor hours (190,000) for the two models.The gross profit on the model was: Royale $500 ($1,500 2 $1,000) and Majestic $540 ($1,200 2 $660). Because of this difference, management is considering phasing out the Royale model and increasing the production of the Majestic model.Before finalizing its decision, management asks the controller, Sally Fields, to prepare an analysis using activity-based costing. Sally accumulates the following information about overhead for the year ended December 31, 2012.

Instructions(a) Assign the total 2012 manufacturing overhead costs to the two products using activity-based costing (ABC).(b) What was the cost per unit and gross profit of each model using ABC costing?(c) Are management's future plans for the two models sound?

Royale $ 700 Majestic $420 Direct materials Direct labor ($20 per hour) Manufacturing overhead ($40 per DLH) Total per unit cost 100 80 160 200 $1,000 $660

Step by Step Solution

3.25 Rating (166 Votes )

There are 3 Steps involved in it

a The allocation of total manufacturing overhead using activitybased costing is as follows Royal... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

54-B-M-A-P-C (125).docx

120 KBs Word File