Question: GiS Inc. has the following four projects on hand: The cash flow in the table is accumulative. Assume that RF = 5%, ERM = 12%,

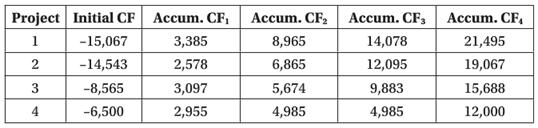

GiS Inc. has the following four projects on hand:

The cash flow in the table is accumulative. Assume that RF = 5%, ERM = 12%, firm-beta = 1.2, after-tax cost of debt = 6.5%. The firm is financed by 40-percent debt and 60-percent equity. Projects 1, 2, and 3 have the same capital structure as the firm, while project 4 has a 1-percent risk premium. Calculate the cost of capital for the four projects using the following methods:

a. The payback period for projects 1, 2, and 3: If the cut-off period for screening projects 1 and 2 is 3.5 years and for project 3 is 2.25 years, which project(s) should be rejected?

b. The discounted payback period method for project 4: If the cut-off period for screening project 4 is 3.25 years, should it be accepted?

Project Initial CF Accum. CF, Accum. CF, Accum. CF, Accum. CF, 1 -15,067 3,385 8,965 14,078 21,495 2 -14,543 2,578 6,865 12,095 19,067 3. -8,565 3,097 5,674 9,883 15,688 -6,500 2,955 4,985 4,985 12,000

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

a r e 5 1212 5 134 WACC 13460 6540 1064 r 1 r 2 r 3 1064 r 4 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

413-B-A-I (4988).docx

120 KBs Word File