Question: Grossman Corporation is considering a new project requiring a $ 30,000 investment in an asset having no salvage value . The project would produce $

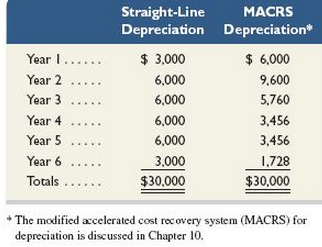

Grossman Corporation is considering a new project requiring a $ 30,000 investment in an asset having no salvage value. The project would produce $ 12,000 of pretax income before depreciation at the end of each of the next six years. The company’s income tax rate is 40%. In compiling its tax return and computing its income tax payments, the company can choose between two alternative depreciation schedules as shown in the table.

Required

1. Prepare a five-column table that reports amounts (assuming use of straight- line depreciation) for each of the following items for each of the six years:

(a) Pretax income before depreciation,

(b) Straight-line depreciation expense,

(c) Taxable income,

(d) Income taxes,

(e) Net cash flow. Net cash flow equals the amount of income before depreciation minus the income taxes. (Round answers to the nearest dollar.)

2. Prepare a five-column table that reports amounts (assuming use of MACRS depreciation) for each of the following items for each of the six years:

(a) Income before depreciation,

(b) MACRS depreciation expense,

(c) Taxable income,

(d) Income taxes,

(e) net cash flow. Net cash flow equals the amount of income before depreciation minus the income taxes. (Round answers to the nearest dollar.)

3. Compute the net present value of the investment if straight- line depreciation is used. Use 10% as the discount rate. (Round the net present value to the nearest dollar.)

4. Compute the net present value of the investment if MACRS depreciation is used. Use 10% as the discount rate. (Round the net present value to the nearest dollar.)

Analysis Component

5. Explain why the MACRS depreciation method increases the net present value of this project.

MACRS Straight-Line Depreciation Depreciation $ 3,000 $ 6,000 Year I...... 6,000 9,600 Year 2 Year 3 6,000 5,760 Year 4... 6,000 3,456 Year 5 6,000 3,456 3,000 Year 6 1,728 Totals .... $30,000 $30,000 *The modified accelerated cost recovery system (MACRS) for depreciation is discussed in Chapter 10.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Part 1 RESULTS USING STRAIGHTLINE DEPRECIATION a Income Before Deprec b StraightLine Deprec c Taxabl... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

267-B-C-F-C-B (1500).docx

120 KBs Word File