H Ltd has one subsidiary, S Ltd. The company has held a controlling interest for several years.

Question:

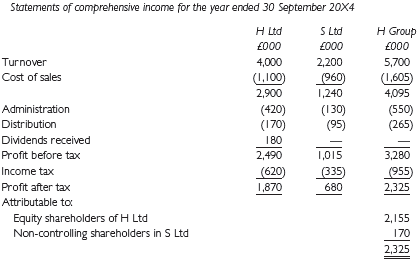

H Ltd has one subsidiary, S Ltd. The company has held a controlling interest for several years. The latest financial statements for the two companies and the consolidated financial statements for the H Group are as shown below:

Goodwill of £410,000 was written off at the date of acquisition following an impairment review.

Required:

(a) Calculate the percentage of S Ltd which is owned by H Ltd.

(b) Calculate the value of sales made between the two companies during the year.

(c) Calculate the amount of unrealised profit which had been included in the inventory figure as a result of inter-company trading and which had to be cancelled on consolidation.

(d) Calculate the value of inter-company receivables and payables cancelled on consolidation.

(e) Calculate the balance on S Ltd’s retained earnings when H Ltd acquired its stake in the company. Non-controlling interests are measured using Method1.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott