Question: Hector Company reports the following: Payments for purchases are made in the month after purchase. Selling expenses are 10% of sales, administrative expenses are 8%

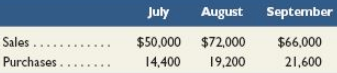

Hector Company reports the following:

Payments for purchases are made in the month after purchase. Selling expenses are 10% of sales, administrative expenses are 8% of sales, and both are paid in the month of sale. Rent expense of $ 7,400 is paid monthly. Depreciation expense is $ 2,300 per month. Prepare a schedule of budgeted cash disbursements for August and September.

July August September Sales.$50,000 $72,000 $66,000 Purchases 14.400 9,200 21,600

Step by Step Solution

3.26 Rating (172 Votes )

There are 3 Steps involved in it

HECTOR COMPANY Budgeted Cash Disbursements For August and September August ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

267-B-C-A-B (736).docx

120 KBs Word File