Helen Campbell and several business friends are considering buying Lewin Foods Inc., a privately owned company. Helen

Question:

Helen Campbell and several business friends are considering buying Lewin Foods Inc., a privately owned company. Helen has just received the financial statements from the present owner and is trying to calculate the bid that should be made to the owners of the company.

Helen realized that the financial statements were not providing enough information to make a decision. So she hired several real estate agents, engineers, and accountants to help her determine the value of the land, machinery, equipment, and working capital.

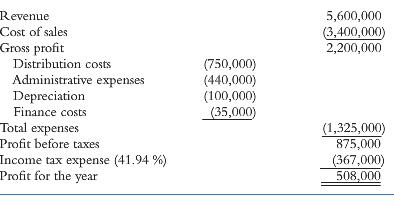

Lewin Foods Inc.’s statement of income and statement of financial position are as follows:

Lewin Foods Inc.

Statement of Income

For the year ended December 31, 2013

(in $)

Although the company is generating $508,000 in profit and $608,000 in cash flow, Helen and her team believe they could increase revenue substantially and reduce costs. After much deliberation, the management team estimates that it could increase the profit for the year to $850,000 and cash flow to $975,000.

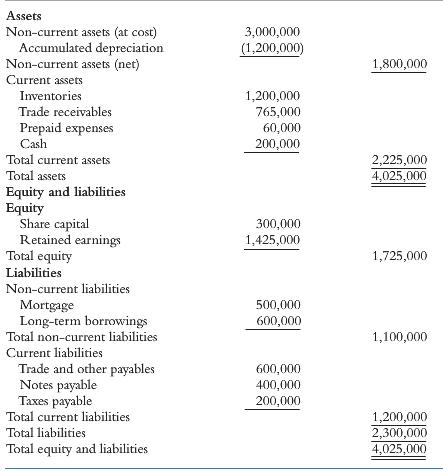

Lewin Foods Inc.

Statement of Financial Position

As at December 31, 2013

(in $)

The consultants and auditors reported to Helen that the trade receivables are worth $650,000, or about 85% of what is currently shown on the company’s statement of financial position. The value of the inventories, however, is not as good. The auditors indicated that only $800,000 would be worth buying, which represents 67% of what is shown on Lewin’s statement of financial position. Helen is prepared to take over all of the trade and other payables. The estimates regarding the property, plant, and equipment assets are as follows:

Land …………………………….. $ 200,000

Buildings ……………………….. 800,000

Equipment ………………………. 1,400,000

Machinery ……………………….. 600,000

Total …………………………….. $3,000,000

During his conversation with Helen, Daniel Lewin, owner of Lewin Foods Inc., indicated that an amount of $700,000 in goodwill would have to be included in the selling price.

Because of the risk, Helen and her partners feel that they should earn at least a 25% internal rate of return on the business. The partners would be prepared to keep the business for 15 years and hope to sell it for $8 million.

Funds raised to purchase the business would come from various sources at a cost of 12%.

1. Would you buy the business?

No, because the investors are looking for a 25% return. At 25%, the NPV is negative; the IRR is 22.3%.

2. If so, how much would you offer Daniel Lewin if you wanted to make a 25% internal rate of return?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Step by Step Answer: