Question: Here is recent financial data on Pisa Construction, Inc. Pisa has not performed spectacularly to date. However, it wishes to issue new shares to obtain

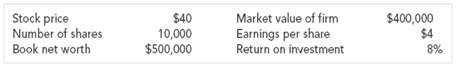

Here is recent financial data on Pisa Construction, Inc.

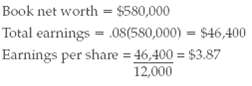

2,000 new shares are issued at $40 and the proceeds are invested. (Neglect issue costs.)

Suppose return on investment doesn?t change. Then

Thus, EPS declines, book value per share declines, and share price will decline proportionately to $38.70."

Evaluate this argument with particular attention to the assumptions implicit in the numerical example.

Market value of firm Earnings per share Return on investment Stock price Number of shares Book net worth $40 10,000 $400,000 $4 8% $500,000

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Pisa Constructions return on investment is 8 whereas investors require a 10 rate of return Pisa p... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-F-D (42).docx

120 KBs Word File