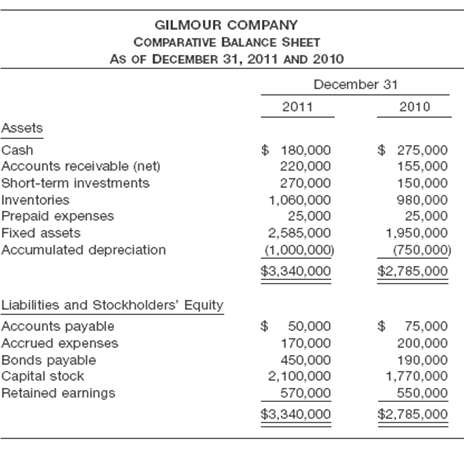

Question: Horizontal and Vertical Analysis presented on page 1370 are comparative balance sheets for the Gilmour Company. (Round to two decimal places) (a) Prepare a comparative

Horizontal and Vertical Analysis presented on page 1370 are comparative balance sheets for the Gilmour Company. (Round to two decimal places)

(a) Prepare a comparative balance sheet of Gilmour Company showing the percent each item is of the total assets or total liabilities and stockholders' equity.

(b) Prepare a comparative balance sheet of Gilmour Company showing the dollar change and the percent change for each item.

(c) Of what value is the additional information provided in part (a)?

(d) Of what value is the additional information provided in part(b)?

GILMOUR COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2011 AND 2010 December 31 2011 2010 Assets $ 180,000 220,000 $ 275,000 155,000 Cash Accounts receivable (net) 150,000 980,000 Short-term investments 270,000 Inventories 1,060,000 25,000 2,585,000 Prepaid expenses Fixed assets 25,000 1,950,000 Accumulated depreciation (1,000,000) $3,340,000 (750,000) $2,785,000 Liabilities and Stockholders' Equity $ 75,000 $ 50,000 170,000 450,000 2,100,000 Accounts payable Accrued expenses Bonds payable Capital stock Retained earnings 200,000 190,000 1,770,000 570,000 550,000 $3,340,000 $2,785,000

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

a Assets Cash Accounts receivable net Shortterm Investments Inventories Prepaid expenses Fixed assets GILMOUR COMPANY Comparative Balance Sheet Decemb... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-F (169).docx

120 KBs Word File