Question: If your instructor has assigned the Appendix to this chapter, redo Problem AP7-5 assuming that the company uses a periodic inventory system. In Problem AP4-5

If your instructor has assigned the Appendix to this chapter, redo Problem AP7-5 assuming that the company uses a periodic inventory system.

In Problem AP4-5

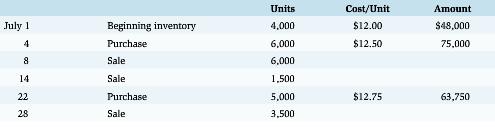

The following information relates to Glassworks Ltd€™s inventory transactions during the month of July

All of the units sold were priced at $20 per unit.

a. Glassworks Ltd. uses the perpetual inventory system. Calculate Glassworks€™ cost of goods sold, gross margin, and ending inventory for the month of July using

i. FIFO

ii. weighted-average

b. Which of the cost flow assumptions would produce the higher gross margin?

Units ,000 6,000 6,000 1.500 5,000 3,500 Cost/Unit $12.00 $12.50 Amount $48.000 75.000 July 1 Beginning inventory Purchase Sale Sale Purchase Sale $12.75 63.750

Step by Step Solution

3.45 Rating (171 Votes )

There are 3 Steps involved in it

a Periodic i FIFO Units Cost per unit Costs July 1 Beg Inv 4000 12 48000 4 Purchase 6000 1250 75000 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

468-B-A-V-I (1204).docx

120 KBs Word File