Question: In an attempt to include all relevant information for decision-making purposes, Merimore Company estimated bad debts using the aging method. However, for external reporting purposes,

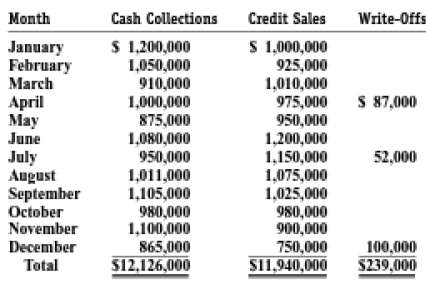

In an attempt to include all relevant information for decision-making purposes, Merimore Company estimated bad debts using the aging method. However, for external reporting purposes, the company estimates bad debts as a percentage of credit sales. Merimore prepares monthly adjusting journal entries. From trends over the past five years, the company controller has estimated that 2 percent of monthly credit sales will prove to be uncollectible. Following are the monthly credit sales and bad debt write-offs for Merimore Company for 2011.

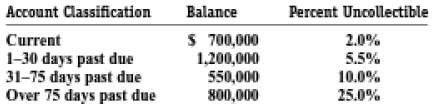

On December 31, 2011, the controller prepared the following aging of accounts receivable:

The allowance for doubtful accounts balance on January 1, 2011, was a credit of $70,000.REQUIRED:a. Prepare the adjusting journal entry necessary on December 31, 2011, so that the statements will be in accordance with the company's external reporting policies. Remember that the company prepares monthly adjusting journal entries.b. Compute the balance in allowance for doubtful accounts after the entry in (a) has been recorded and posted.c. Compute the balance in accounts receivable as of January 1, 2011.d. Prepare the December 31 adjusting entry for bad debts, using the percentage-of-credit-sales method, and compute the estimated bad debts, using the aging method.e. Why would a company want to estimate bad debts using two different methods? Which of the two methods is more costly and time-consuming to implement? Which provides more usefulinformation?

Month Cash Collections Credit Sales Write-Offs S 1,00,000 925,000 1,010,000 975,000 S 1,200,000 1,050,000 910,000 1,000,000 875,000 1,080,000 950,000 1,011,000 1,105,000 980,000 1,100,000 January February March S 87,000 April May June 950,000 1,200,000 1,150,000 1,075,000 1,025,000 980,000 900,000 750,000 S11,940,000 July August September October November December 52,000 865,000 $12,126,000 100,000 $239,000 Total

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

a Bad Debt Charge E SE 15000 Allowance for Doubtful Accounts A 15000 Estimated bad debt charge 15000 750000 December credit sales x 2 Estimated uncollectible percentage b Ending allowance balance Begi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-I-A (692).docx

120 KBs Word File