Question: In recent years, Juresic Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for

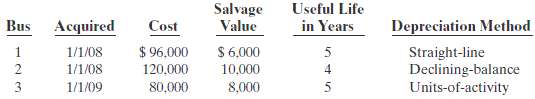

In recent years, Juresic Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is summarized below.

For the declining-balance method, the company uses the double-declining rate. For the units-of activity method, total miles are expected to be 120,000. Actual miles of use in the first 3 years were: 2009, 24,000; 2010, 34,000; and 2011, 30,000.Instructions(a) Compute the amount of accumulated depreciation on each bus at December 31, 2010.(b) If bus no. 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2008 and (2)2009?

Salvage Useful Life Depreciation Method Straight-line Bus Value in Years Acquired Cost $ 96,000 120,000 $6.000 1/1/08 1/1/09 4 10,000 Declining-balance Units-of-activity 80,000 8,000 5

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

a Year Computation Accumulated Depreciation 1231 BUS 1 2008 2009 2010 90000 X 20 18000 90000 X 2... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-A-I-A (201).docx

120 KBs Word File